The 2024 Finance Bill in Kenya has introduced several significant changes aimed at enhancing revenue collection and economic growth. These changes, while intended to bolster the nation’s financial stability, have sparked considerable debate and concern among various stakeholders. This article delves into the key proposals of the 2024 Finance Bill, their potential impacts, and the legal avenues available to Kenyans who may be affected by these changes.

Key Proposals in the 2024 Finance Bill

- Motor Vehicle Tax: A new tax set at 2.5% of the vehicle’s value, with a minimum of KES 5,000 and a maximum of KES 100,000. This could increase the cost of vehicle ownership and impact the automotive market.

- Extended Decision Timeframe: The Kenya Revenue Authority will have up to 90 days to issue decisions, extended from the current 60 days. This may affect the efficiency of tax dispute resolutions.

- VAT Registration Threshold: The threshold for VAT registration is proposed to increase from KES 5 million to KES 8 million. This change could relieve smaller businesses from the administrative burden of VAT compliance.

- International Top-up Tax: Implementation of a 15% minimum top-up tax for multinational entities, aligning with global tax reforms. This could affect foreign investment and international business operations in Kenya.

- Excise Duty on Luxury Goods: An increase in excise duty on luxury goods such as alcohol, tobacco, and high-end vehicles has been proposed. This measure is intended to discourage the consumption of harmful products and generate additional revenue, though it may lead to higher retail prices for these items.

- Corporate Tax Adjustments: The bill includes provisions for a higher corporate tax rate for multinational companies operating in Kenya. This change aims to ensure that large corporations contribute a fair share of taxes but could deter foreign investment if not carefully implemented.

Impact of the Proposed Changes

The proposed changes in the 2024 Finance Bill are expected to have a multifaceted impact on the Kenyan economy and its citizens:

- Economic Growth: Increased tax revenues could provide the government with the resources needed for infrastructure development and social programs, potentially spurring economic growth.

- Cost of Living: Higher VAT and excise duties are likely to increase the cost of living, particularly affecting lower and middle-income households.

- Business Environment: Changes in corporate taxation and the introduction of digital services tax could influence the business environment, potentially affecting foreign investments and the growth of the digital economy.

- Income Inequality: Progressive income tax reforms aim to reduce income inequality, though their effectiveness will depend on efficient implementation and enforcement.

Legal Actions and Recourse for Kenyans

Kenyans who are adversely affected by the 2024 Finance Bill have several legal options to address their concerns:

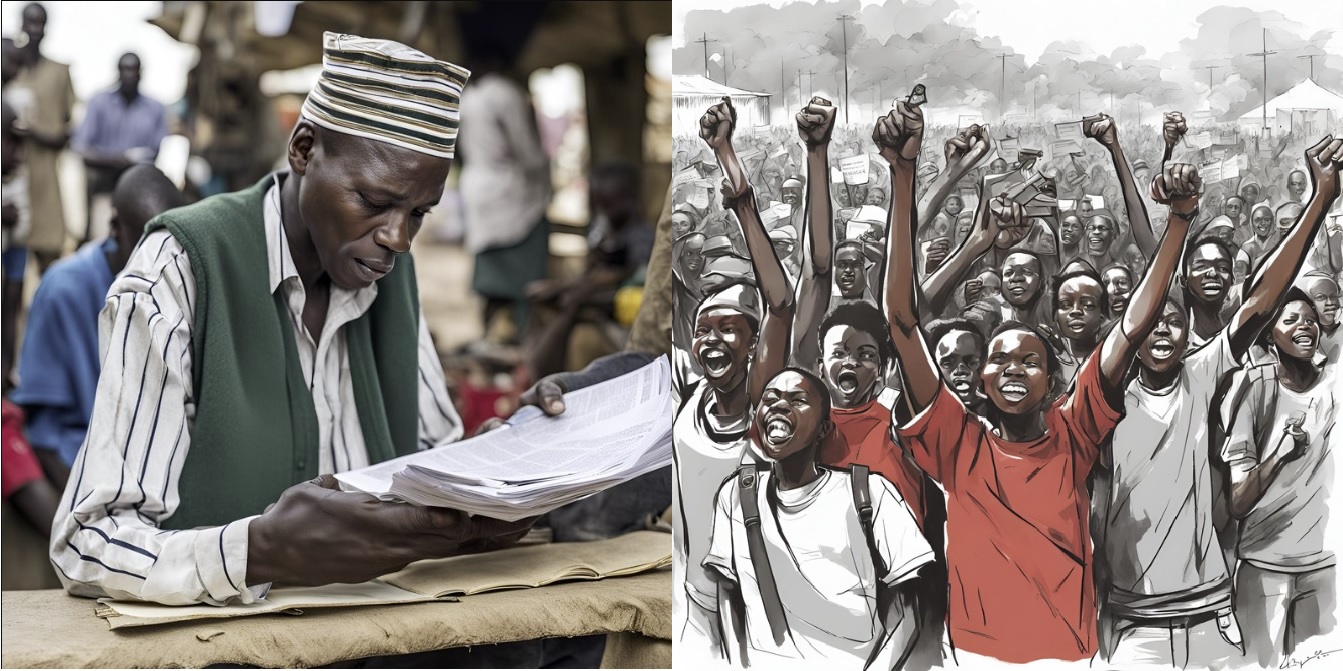

- Public Participation: Under the Kenyan Constitution, citizens have the right to participate in the legislative process. Kenyans can engage in public forums, submit their views to parliamentary committees, and lobby their representatives to advocate for or against specific provisions of the bill.

- Judicial Review: If any part of the Finance Bill is perceived to violate constitutional rights or principles, affected individuals or groups can file a petition in the High Court for judicial review. The court has the power to annul legislation that is found to be unconstitutional.

- Civil Society Advocacy: Non-governmental organizations and civil society groups can play a crucial role in advocating for changes to the bill. These organizations can organize awareness campaigns, legal challenges, and negotiations with the government.

- Parliamentary Petitions: Citizens can submit petitions to Parliament, urging lawmakers to reconsider or amend specific aspects of the Finance Bill. This process allows for direct communication with legislators and can influence parliamentary debates and decisions.

The 2024 Finance Bill presents a mix of opportunities and challenges for Kenya. While the proposed changes aim to enhance revenue collection and promote economic growth, they also raise concerns about increased living costs and potential impacts on the business environment. Kenyans have several legal avenues to address their concerns, including public participation, judicial review, and advocacy through civil society. It is essential for citizens to remain informed and engaged in the legislative process to ensure that their voices are heard, and their rights protected.